Many of the best things we love aren’t exactly cheap. Luxury items like cars can be pretty expensive, and paying for them completely up-front can be a big ask. It’s the same with timeshares. Vacation ownership is a luxury good that timeshare owners get a lot of value out of, but it can be expensive. Between the initial cost and annual maintenance fees, the price of timeshare ownership can seem a bit daunting. Fortunately, there’s a way to buy a timeshare without having to take on a big financial burden: finance your next timeshare purchase. Here’s everything you need to know about timeshare financing.

About Timeshare Financing

Having cash in hand is great if you are able to afford it, but everyone’s circumstances and financial goals are different. If paying for a timeshare property upfront is too pricy for you, timeshare financing is worth considering. Financing allows buyers to spread out their timeshare costs instead of parting with all of their funds at once. Pay a hefty chunk or as little as 20% of the purchase price as a down payment. Wiping out savings is ill-advised. It’s a much wiser decision to leave an emergency fund in your savings account for unexpected costs that sometimes arise.

Timeshare Financing Options for Buyers

Buyers that finance can use some of that cash to actually go on vacation and enjoy their new purchase. Why pay $10,000 today for 10 years of future accommodations when you can pay $1,000 each year (plus a small amount of the interest rate) for ten years? Not to mention enjoying the same accommodations for that same amount of time.

Financing will allow you to get the vacation package that you otherwise can’t afford upfront. You can have your choice of premium accommodations and the best seasons more suited for your family’s lifestyle. Rather than settling and trying to save money to upgrade later, financing a timeshare will open up more options.

Enjoy Flexible Timeshare Financing

This doesn’t mean taking on an interest rate or a bigger loan for investment property that’s not as affordable. Your resale broker can provide you with options and price ranges on vacation ownership best suited for you. Use this easy timeshare financing calculator to see prices vs. down payments. Pick the one that you are most comfortable with, without stretching your budget.

Read more: What is Vacation Ownership?

Timeshares Are Not Investments

Although timeshares depreciate in value, investing in your family’s happiness is priceless. If you are planning on vacationing as often as your lifestyle and career allows, purchasing a timeshare is a great choice. It’s well known that the superior accommodations over hotels will bring many happy memories, while also avoiding the discomfort of sharing small spaces with little amenities.

We purchase assets that depreciate all the time, like a car for example. If you are comfortable with the fact that a vacation is an expense just like a car payment, why not save cash and finance the larger purchases?

It’s implied in the “cash-only model” that all debt is inherently bad. This is not completely true. Paying cash for everything wouldn’t build a healthy history of credit, which can actually hurt in the long run. Having good credit when applying for car insurance or a loan can verify you are responsible and able to follow through on your commitments.

Is Timeshare Worth It?

Timeshares are not considered an investment, however, you can pay for your vacations to come at today’s price. When you become an owner, you’ll have to pay timeshare maintenance fees, so this is something to consider as well when determining your budget. The great thing about timeshares is that you are typically no longer locked into visiting the same resort each year. Nowadays timeshare resorts and developers offer greater flexibility when it comes to visiting new places. In addition, owners can join vacation exchange networks like RCI (formerly Resort Condominiums International) or Interval International to get even more out of their ownership.

Improve Your Credit Score

Financing a timeshare purchase can actually help increase your credit score. By using a lender that reports to credit bureaus you can benefit from making payments on time. Regardless of the price and down payment you choose, make sure your loan does not have additional monthly fees or a prepayment penalty. These add to the cost and can erase all the savings you made on the original purchase. You should be able to make your monthly payments on just the principle and interest.

How to Save Even More Money on Timeshares

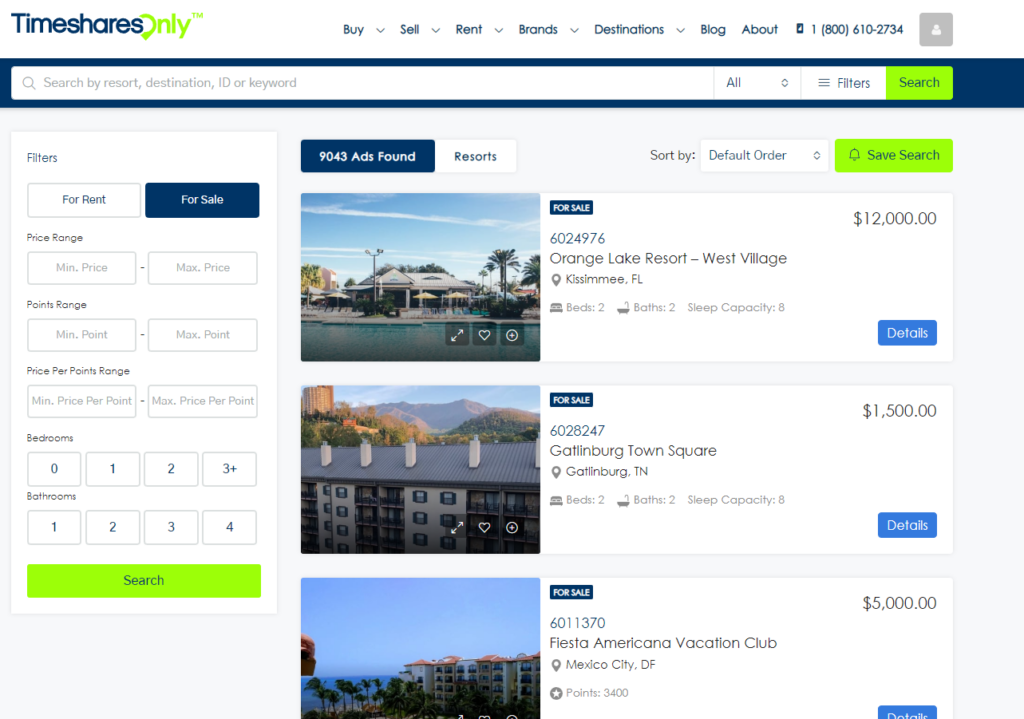

If you want to save even more money on vacation ownership, consider purchasing on the secondary market. Timeshare resales allow you to purchase a timeshare for a lower price than buying directly from a resort developer. Plus, you’ll still be able to enjoy the same luxurious amenities and spacious accommodations. By combining buying a timeshare on the resale market with a timeshare loan, you’ll be able to save money while taking the vacation of your dreams.

What to Do if You’re Not Ready to Finance a Timeshare?

Want to take an exciting vacation but aren’t sure if you want to finance a timeshare? If you’re still on the fence about vacation ownership, a timeshare loan might be a bit intimidating. Fortunately, there’s a great way to try a timeshare before you buy: renting a timeshare. With a timeshare rental, you’ll be able to visit a fantastic resort for an unforgettable adventure, without having to worry about committing to maintenance fees or a timeshare loan. It’s all of the benefits with none of the commitment. What’s not to love? You can check out our marketplace for timeshare rentals today!

Ready to Finance Timeshare?

Contact Vacation Club Loans for a free credit evaluation and quote if you would like to learn more about financing your next timeshare purchase. They have helped many new owners finance their timeshares. With options for loans that can help you get that Hilton, Marriott, or Wyndham timeshare you’ve been considering, it makes shopping easier. The range of brands Vacation Club Loans helps to finance is vast. If money has been holding you back, we recommend talking to their trusted and licensed experts.

Learn more: Wyndham Timeshare Financing Makes Vacations Easier

Why Finance Your Timeshare With Vacation Club Loans?

While financing your timeshare may sound good, you might also be wondering why you should work with Vacation Club Loans. Vacation Club Loans offers plenty of benefits for timeshare loans no matter what vacation clubs you’re interested in. The company’s quick and easy approval process makes getting a timeshare loan stress-free. In fact, you only need a 600 FICO credit score for instant approval! With so many ways to get fast credit approval, you won’t be waiting long for the vacation of your dreams. Interest rates start as low as 9.9% APR based on creditworthiness, and there’s only a 10% down payment. There are no hidden fees, no monthly fees, no prepayment penalties, and all loan origination fees are waived at closing. So you’ll never be caught off guard the way you might with other loan funding programs.

How Financing a Timeshare Works With Vacation Club Loans

When you send in a timeshare loan request, you’ll get a quick response about whether or not you pre-qualify. From there, expert loan specialists will send you an email with personalized financing options. After you review and accept your loan, you’ll sign loan documents and be able to buy a timeshare. No need to sit through a long timeshare presentation, just find the one you like and make an offer! It’s really that simple. No matter what timeshare developer you’re interested in, Vacation Club Loans has a fast online approval process and competitive rates to help you buy a timeshare. If you’re ready to get the application process started, click on the link below! Still have questions? We’re here to help! Feel free to give us a call at 1-800-610-2734 or email us at [email protected].